Welcome to the official website of Shenzhen Dankai Technology Co., Ltd.!

Sitemap | contact us | Online message | CN

Telephone:

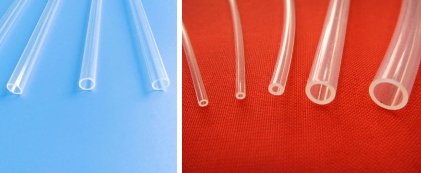

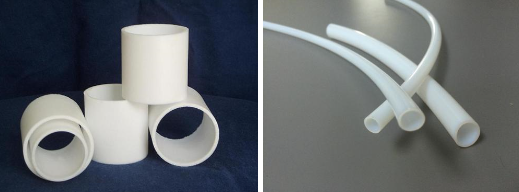

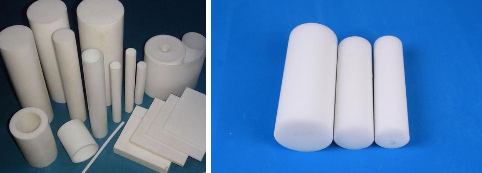

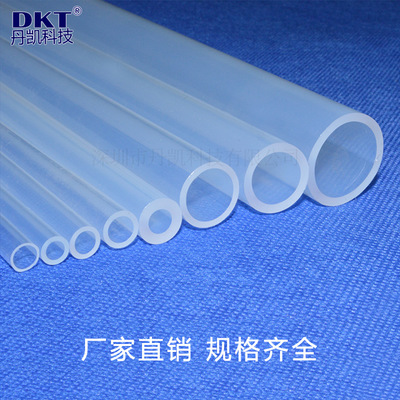

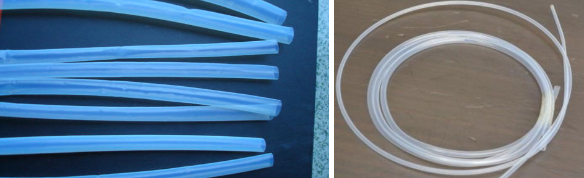

+8615158121839Hot key words:Polyperfluoroethylene propylene(FEP/F46) PTFE Teflon series PFA PVDF

News

Telephone:

+8615158121839Information details

The traditional trade model of plastics is no longer bright

- Categories:Industry news

- Author:Miss Teflon tube

- Origin:Miss PTFE tube

- Time of issue:2014-08-02 17:43

- Views:

The traditional trade model of plastics is no longer bright

- Categories:Industry news

- Author:Miss Teflon tube

- Origin:Miss PTFE tube

- Time of issue:2014-08-02 17:43

- Views:

"Earning the money for selling cabbage, and having the heart of selling white powder." This sentence is quite appropriate to describe the current situation of plastic traders.

Recently, Mr. Wang from the sales department of a plastic trading company vomited bitterly. "Ten years ago, the profit per ton of the plastics trade could reach 500 yuan, even thousands of yuan. Five years ago, it could earn 200 yuan per ton, but now the profit is almost negligible, and losses occur from time to time." Mr. Wang introduced that, especially in the past two years, the profit margin of the plastics industry is very low, and the business environment is not optimistic. Traders go bankrupt and run away frequently. In order to maintain the treatment of high-level agents, traders can be said to have suffered a lot. Buying high and selling at low and trading volume at par is also a last resort.

Not only that, the current market has also put forward higher requirements on the speed of traders' price response. It is understood that the frequency of price fluctuations in the plastics industry has accelerated in the past two years, but the more obvious seasonal trend in the past is no longer there. The market often appears in the off-season but not the peak season.

In the past two years, petrochemical companies have begun to attach importance to the connection between upstream and downstream, and continue to increase the direct sales rate of their products. The role of traders as an industrial buffer zone has been greatly weakened. Coupled with the upside-down of import profits, the previous model of operating plastics trade based on experience is no longer feasible, and it is becoming more and more difficult for traders to do it.

In fact, these changes in the plastics industry seem to be reasonable to most people in the industry. In recent years, the introduction of futures tools, the rapid expansion of production capacity, and the involvement of coal chemical products have jointly promoted certain changes in the plastics industry. On the one hand, after the listing of LLDPE, the spot price is more transparent, and the price continuity increases, which reduces the space for market speculation; on the other hand, the continuous expansion of production capacity in recent years has increased the self-sufficiency rate of low-end products and enhanced the stability of the balance of supply and demand. The price volatility has narrowed.

In addition, as an important technological innovation, coal chemical industry has broken the traditional monopoly of naphtha-produced polyolefins. In particular, the cost of coal chemical raw materials is now far lower than that of petrochemicals, which has impacted the price of traditional petrochemical polyolefin products.

Although the current petrochemical manufacturers still have a strong ability to control prices, and the "two barrels of oil" accounted for the vast majority of the plastic raw material market, it should not be overlooked that once the coal chemical industry is put into production in large quantities, in the field of plastic raw materials, especially general materials, It will bring a large number of product increments, and the cost advantage of coal-to-olefins will also make it very competitive. Because the current supply of plastic materials in the plastic raw material market is still not surplus, the coal chemical industry and the "two barrels of oil" will both receive in the short term A certain market share.

In the medium and long term, with the continuous improvement of coal chemical technology, the trend of product diversification becomes more obvious, and the degree of dependence on foreign sources of domestic medium and low-end sources will drop significantly. In addition to traditional domestic trade being impacted by coal chemical products, import trade may not escape bad luck. The entry of coal chemical products will accelerate the integration of intermediate traders, and traders who cannot transform may be gradually annexed by large traders or directly eliminated by the market.

"Traditional trade models are obviously unable to adapt to the current market environment. In the future, plastics trading companies will face more severe challenges." A general manager of a plastic products company said that capitalization and specialization are undoubtedly the direction of the transformation of traders. In his view, traders must make good use of plastic futures as a tool to hedge and lock in profits in time when prices deviate from value; on the other hand, they must keep up with product changes during the market transition period and seize the opportunities provided by coal chemical products. .

More news

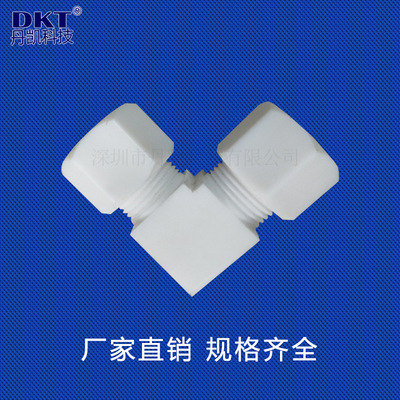

Landline: 0755-29979617

Cell phone: 15818669373

Add WeChat, free sample

Follow the corporate public account

Shenzhen Dankai Technology Co., Ltd.

Address: Area B, 4th Floor, Building 1, North Yongfa Science and Technology Park, Yanchuan North, Chaoyang Road, Songgang Town, Bao'an District, Shenzhen

Tel: 0755-29979617 23127719 23127819

Fax: 86-0755-29979492

Follow us

Page copyright©1998-2024 Shenzhen Dan Kai Technology Co., Ltd. Guangdong